GM daily digest: Rev-GOP conversion explained

What is Rev-GOP conversion?

Rev-GOP conversion is a measure of whether the costs are under control.

Your conversion or flow-thru goal is the expected GOP if all revenue variances flow into profit at the expected level. It indicates whether any extra sales are flowing efficiently into profits or whether costs increase too much.

For example, if revenues are $50,000 higher this month than forecasted, how much of the $50,000 should make it through to the profit line? How much will flow? Monitoring this provides a simple overview of cost efficiency – are costs increasing too much when additional revenue is made?

The measure has most value when checked after month end, once the final level of costs is known.

What does the Rev-GOP conversion show?

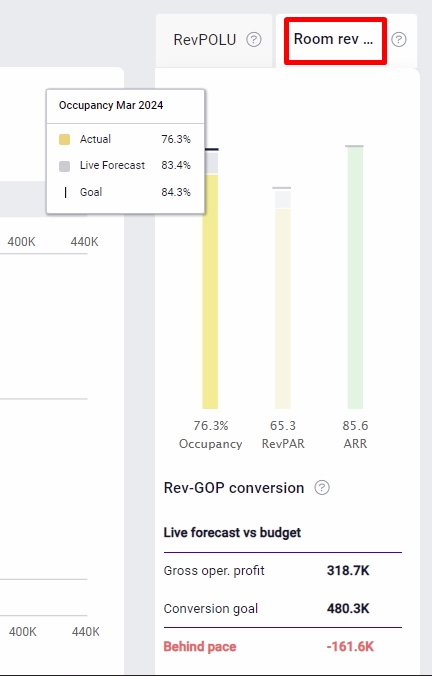

- The Gross opperating profit line is the Live forecast GOP for the end of the month. For past months it shows actual GOP.

- The conversion goal is the expected GOP if all revenue variances flow into profit at the expected level as set in settings.

- The last line deducts the conversion goal (target GOP) from your Live forecast GOP (expected GOP) to indicate whether you are on pace, near pace or behind pace compared to the conversion goal.

How does it work?

The conversion calculation starts from the last approved forecast, budget or last year actuals for the same period (as selected in settings). During the month, revenue tracked in Live forecast gradually deviates from the source. The conversion calculation tracks whether any improvement in revenue is having the expected effect on GOP, if Live forecast is lower than source, or whether GOP has gone down by the expected amount. It is a measure of whether the costs are under control. If revenue is up and the conversion is negative, then the extra business is not profitable enough, or lots of extra costs have been incurred.

For this to work well, it is important that the settings accurately reflect the marginal profit expected from sales at that volume level. Because it is only looking at the small variations from the source, the fixed business costs should already be covered. It is only the variable costs relating to that revenue that should be in the measure.

How to set a conversion goal?

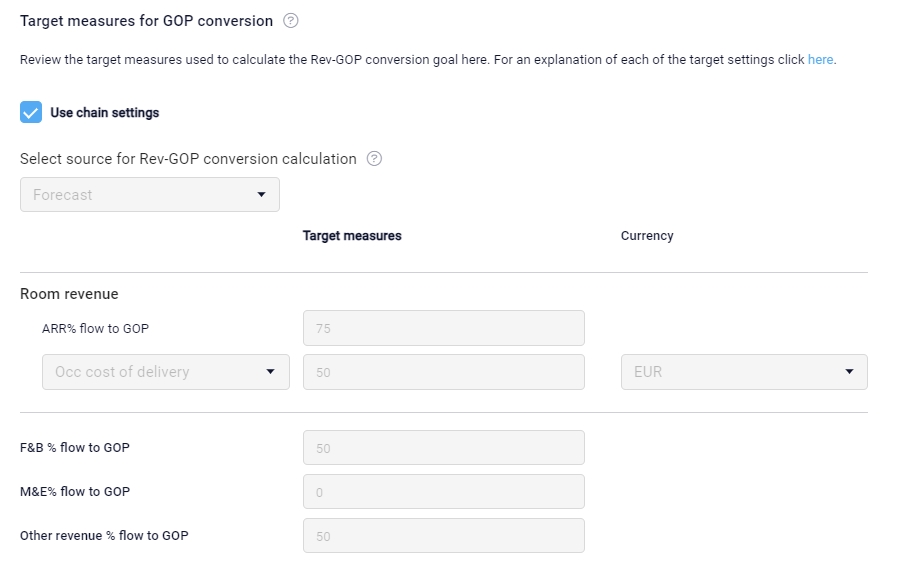

Click on the settings icon in the top right corner to view the targets. Conversion targets are set at chain level. It is possible to adjust these for individual property, but we recommend using the chain standards for consistency. The chain settings should be static. Contingent on group policies, these can be reviewed every few years, typically by the head office.

First, identify what you want the goal to be compared against. The options are Last year actuals, Budget, or Forecast.

To set the conversion goal, you need to look at the main revenue streams and consider what level of direct/variable costs arises from a change in revenue for each. Room revenue is split further between changes in ARR and changes in occupancy. For occupancy, you can either set an actual amount for the expected costs of using the room, or a percentage flow to GOP.

See below for a detailed description of each target setting:

ARR% flow to GOP:

When average room rate is higher than the source, what percentage of that additional revenue should flow through to GOP? There may be some additional costs due to increased room rate, for example, increased third-party commissions, credit card commissions, centralized fees, and management fees. The rest of the additional revenue should flow directly through to GOP.

Occupancy cost of delivery:

For each additional occupied room over selected source data (forecast, budget or last year), how much extra do you expect to spend on that room? This can include housekeeping labor hours, electricity, linens, cleaning equipment etc. This value is input as a monetary value in your local currency and is deducted from the ARR% flow value to make up the total expected effect of room revenue variances on profit.

Occupancy % flow to GOP:

When occupancy varies from the source data, what percentage of that additional revenue should flow thru to GOP? There may be additional costs due to increased occupancy, for example housekeeping and maintenance costs. The rest of the additional revenue should flow directly to GOP.

Food & beverage % flow to GOP:

For additional F&B revenue, what percentage do we expect to reach the GOP? Take into consideration food purchases and staff needed to supply the additional covers.

Other revenue % flow to GOP:

For all other additional revenue, what percentage do we expect to reach the GOP?

-

Getting started

-

-

- Arrivals/Departures

- Data elements required from PMS

- Manual Export PMS – Fidelio

- How to do a manual PMS export from Opera

- Manual Export PMS – Picasso

- Manual Export PMS – Protel

- Manual Export PMS – Spirit Web

- PMS – Cenium

- PMS – Citybreak

- PMS – Fidelio

- PMS – Opera

- PMS – Protel

- How to do a manual PMS export from HotSoft

-

Video tutorials

-

- Administration Labor cockpit [14:49]

- Bar and Pub Labor cockpit [12:21]

- Breakfast Labor cockpit [12:05]

- Consolidated view in Benchmarking and Management Perspective [3:20]

- Flash Report Onboarding [6:27]

- Flash Report Overview [2:25]

- Food cost cockpit [6:21]

- Kitchen Labor cockpit [11:28]

- Labor Cockpit Onboarding [18:16]

- Labor Cockpit Overview [3:12]

- Live Forecast 1/5 Navigation [5:05]

- Live Forecast 2/5 Rooms [5:05]

- Live Forecast 3/5 Meeting & Event [5:40]

- Live Forecast 4/5 Food & Beverage [6:11]

- Live Forecast 5/5 Breakfast [7:19]

- Live Forecast Onboarding [6:06]

- Live Forecast Overview [2:58]

- Management Perspective Overview [3:06]

- P&L Planning 1/10 Purpose and benefits [2:25]

- P&L Planning 10/10 How to approve forecast and budget or target [2:34]

- P&L Planning 2/10 Navigation [4:26]

- P&L Planning 3/10 How to build a total [4:29]

- P&L Planning 4/10 Three ways of inserting figures [4:32]

- P&L Planning 5/10 How to add a sub account [1:42]

- P&L Planning 6/10 How to build a constant [2:42]

- P&L Planning 7/10 Staff module [2:48]

- P&L Planning 8/10 How to add a staff member [1:33]

- P&L Planning 9/10 How to revise and submit a forecast [3:01]

- PMI Planning Staff Module Overview [3:07]

- Repair and Maintenance Labor cockpit [13:01]

- Restaurant Labor cockpit [12:30]

- Schedule 1/8 Navigation [5:12]

- Schedule 2/8 How to create a labor cockpit schedule [4:29]

- Schedule 3/8 How to add a team member [2:07]

- Schedule 4/8 How to create a shift code [3:30]

- Schedule 5/8 How to add shift codes to team members [3:41]

- Schedule 6/8 How to create a rotating schedule [3:20]

- Schedule 7/8 How to replace shift codes for a period [2:00]

- Schedule 8/8 How to create split shifts between departments [2:42]

- Stewarding Labor cockpit [11:38]

- Timesheet Onboarding [4:14]

- Show all articles ( 26 ) Collapse Articles

-

- Articles coming soon

-

- Administration Labor cockpit [14:49]

- Bar and Pub Labor cockpit [12:21]

- Breakfast Labor cockpit [12:05]

- Food cost cockpit [6:21]

- Front Office Labor cockpit [12:05]

- Housekeeping Labor cockpit [11:20]

- Kitchen Labor cockpit [11:28]

- Labor Cockpit Onboarding [18:16]

- Labor Cockpit Overview [3:12]

- Repair and Maintenance Labor cockpit [13:01]

- Restaurant Labor cockpit [12:30]

- Schedule 1/8 Navigation [5:12]

- Schedule 2/8 How to create a labor cockpit schedule [4:29]

- Schedule 3/8 How to add a team member [2:07]

- Schedule 4/8 How to create a shift code [3:30]

- Schedule 5/8 How to add shift codes to team members [3:41]

- Schedule 6/8 How to create a rotating schedule [3:20]

- Schedule 7/8 How to replace shift codes for a period [2:00]

- Schedule 8/8 How to create split shifts between departments [2:42]

- Stewarding Labor cockpit [11:38]

- Timesheet Onboarding [4:14]

- Show all articles ( 6 ) Collapse Articles

-

- How to create a pre-populated new plan for Budget or Forecast [3:02]

- How to edit a plan [3:52]

- P&L Planning 1/10 Purpose and benefits [2:25]

- P&L Planning 10/10 How to approve forecast and budget or target [2:34]

- P&L Planning 2/10 Navigation [4:26]

- P&L Planning 3/10 How to build a total [4:29]

- P&L Planning 4/10 Three ways of inserting figures [4:32]

- P&L Planning 5/10 How to add a sub account [1:42]

- P&L Planning 6/10 How to build a constant [2:42]

- P&L Planning 7/10 Staff module [2:48]

- P&L Planning 8/10 How to add a staff member [1:33]

- P&L Planning 9/10 How to revise and submit a forecast [3:01]

- PMI Planning Staff Module Overview [3:07]

-

- PMI GoGreen - Cockpit overview [2:49]

- How to create a pre-populated new plan for Budget or Forecast [3:02]

- PMI GoGreen - Water [3:04]

- PMI GoGreen - Missed opportunities [2:57]

- PMI GoGreen - Register actual consumption [2:24]

- PMI GoGreen -Towels & linens [3:02]

- PMI GoGreen - How to prevent food waste [3:03]

- PMI GoGreen - How to reduce energy waste [3:08]

- PMI GoGreen - Waste [3:04]

-

-

PMI Release notes

-

- User administration enhancements March 2024

- GM daily digest enhancement March 2024

- PMI Index calculation updates for 2024

- KPI targets enhancement February

- KPI targets enhancement

- Update to NextGen Rooms live forecast page: Personal view options, Mar 2024

- Consolidation OTB enhancement - April 2024

- PMI adoption index enhancements - April 2024

-

- GoGreen benchmarking

- GoGreen index calculation enhancement

- PMI adoption Index: Help videos for measurements

- Activity log enhancement

- Arrivals and departures forecast enhancement

- KPI upload tool enhancement

- GoGreen Food waste cockpit enhancement

- GoGreen Doing cockpit enhancement

- Benchmarking: PMI Index value updates based on time period selected

- GoGreen cockpit: Highlight months missing data on 12 month graph

- KPI targets

- Goal distribution tool

- Planning set up enhancement: Roll forward forecast

- Live forecast enhancement: Editing ARR values

- User administration release note

- New page view of Rooms live forecast - Dec 2023

- Show all articles ( 1 ) Collapse Articles

-

- 15th of March – Ability to reverse Benchmarking calculation

- 15th of March – Possibility to add department type as an additional dimension when using Account ID in the P&L report

- 15th of March – Print a list of all unmapped accounts on chain level

- 15th of March – Printing to excel and PDF

- 16th of March – Introduction to PMI

- 26th of April – Room Live Forecast – Change to pickup fields

- 5th of September – New Import Status

- 7th of September – Information/calculation rows in PMI schedule

- 9th of August – Export to Google Sheets

- 9th of June – PMI Advanced settings – Period locking

- GM daily digest enhancements

- PMI adoption index: Option to filter scores by group and export scores

- Profit center Live forecast: Automatically switch between OTB and revenue driver

- SMART Forecast enhancement

-

-

Onboarding

-

- Onboarding roles – Breakfast

- Onboarding roles – Finance

- Onboarding roles – Food cost

- Onboarding roles – Front Office

- Onboarding roles – Housekeeping

- Onboarding roles – Kitchen

- Onboarding roles – Restaurant and Meeting & Event

- Onboarding roles – Stewarding

- Onboarding roles – Repair and Maintenance

- GM Introduction to PMI

- Onboarding roles – Bar and Pub

- Onboarding roles – Administration

-

-

GM's corner

-

PMI homepage

-

PMI planning

-

- Setting Productivity Targets and/or Hours

- How to set productivity targets and/or hours in Budget & Forecast module

- Room Budget and Forecast

- Other Budget and Forecast

- Use Forecast/Budget hours from Cockpit in P&L Staff module

- What is Room revenue planning?

- Express planner overview

- How the Express planner works

- Express planner: Settings explanation

- Operational targets overview

- How to input a budget in PMI

-

- Accounts overview

- How to populate and edit accounts

- How to approve a forecast or budget in PMI

- How to copy from reference

- How to edit and update using the staffing tool

- How to make a profit forecast

- How to set up a weekly Live forecast

- How to add a comparison year in P&L

- How to modify a P&L report

- Planning Menu – Tools and View Options overview

- Planning staff module overview

- How to build a report

- How to add staff and manage staff cost

- Staffing screen overview

- How to input a budget in PMI

-

-

Cockpit

-

- Labor cockpit overview

- Labor Cockpit Preparations

- Labor Cockpit Cost Driver

- Daily routines, Labor Cockpit

- SMART forcast explained

- How does SMART allocate daily hours?

- Using Arrivals and/or Departures as Cost Driver

- Closing Profit Center or Cockpit

- How to handle labor cost

- Min/Max Explanation

- Parent and sub-cockpits explanation

- Staffing guide explanation

- Timesheet overview

- How to link KPI targets to a cockpit

-

- Labor cockpit schedule

- How to make a schedule

- How to revise a schedule

- PMI Schedule: Information, Calculation rows explanation

- Predefined shift codes

- Printing a schedule

- Revise staff

- Schedule 1/8 Navigation [5:12]

- Schedule 2/8 How to create a labor cockpit schedule [4:29]

- Schedule 3/8 How to add a team member [2:07]

- Schedule 4/8 How to create a shift code [3:30]

- Schedule 5/8 How to add shift codes to team members [3:41]

- Schedule 6/8 How to create a rotating schedule [3:20]

- Schedule 7/8 How to replace shift codes for a period [2:00]

- Schedule 8/8 How to create split shifts between departments [2:42]

- Scheduling

- Split Shifts Between Departments

- The Schedule Tools & View menu

- Show all articles ( 3 ) Collapse Articles

-

-

Live forecast

- Live Forecast Overview

- How to set up a Live forecast: configuration settings

- Live forecast tools and personal view settings

- PMI prediction explanation

- Pickup explanation

- Profit center Live forecast: Automatically switch between OTB and revenue driver

- Revenue Driver explanation

- Segment OTB

- Submit Live Forecast to Forecast (monthly routine)

- NextGen Rooms live forecast overview

- Rooms live forecast: weekly routine overview

- Rooms live forecast: How to work with auto Live forecast

- NextGen Rooms live forecast: Personal view options

-

Data analysis views

-

Administration

-

GoGreen

-

- Comparative data explained

- Data table general explained

- Formula/Calculations explained

- Goal charts and YoY comparison explained

- GoGreen Learning page overview

- How to edit a GoGreen plan

- How to set up a Plan

- Intro to NextGen GoGreen Planning

- Main chart explained

- Plan values explained

- Save your progress explained

- Sense check mode explained

- Unit price explained

- Volume/usage/consumption explained

- How to do a monthly forecast routine in NextGen Planning

- How the GoGreen targets are calculated

- Show all articles ( 1 ) Collapse Articles

- GoGreen Doing Cockpit overview

- GoGreen index overview

- GoGreen benchmarking

- GoGreen index: How are the measurements calculated?

- GoGreen Learning page overview

- Useful links for sustainability and environmental management best practice

- Chart explained

- GoGreen targets explanation

- How to make a manual entry in a GoGreen cockpit

-

-

FAQ

-

- How can I see the hours that are imported to PMI?

- How do I enter the rates?

- How do I know if I am scheduling according to activity?

- How does PMI summarize the hours?

- How is productivity calculated?

- What are fixed hours?

- What are non-productive and productive hours?

- What are the rates and how are they calculated?

- What is a cost driver?

- What is min/max hours?

- What is SMART?

- Why do the planned hours in the Timekeeping System (TKS) not match PMI?

- Why is the total number of hours for the month too low/high?

-

- How do I estimate my Closing Inventory?

- My food cost % is wrong (too high/low). Why is that?

- My turnover days are set to 32. What does that mean?

- What are my routines in the Food cost cockpit?

- What do I enter in the Purchase column?

- What is opening and closing stock?

- What is the recommended number of turnover days?

- What is turnover days and how is it calculated?

- Where do I change my food cost forecast?

- Why is opening and closing stock important?

-

- Can one employee work in two departments?

- How do I add a shift code?

- How do I copy hours into the unspecified row (Timekeeping system excluded)

- How do I create a rotating schedule?

- How do I make a new schedule?

- How do I navigate the tools in the schedule?

- What are timekeeping system (TKS) excluded hours for?

-

- How do I copy to Live forecast?

- How do I submit my Live forecast to forecast?

- How do I reset the pickup for a full month?

- Why do I have a red triangle to the left of the date?

- What is Pickup statistics?

- What are covers?

- What are the seasons in PMI?

- What do the pickups show and why are they sometimes negative?

- What is a revenue driver?

- What is the difference between Forecast and Live forecast?

- Why does on the books in PMI not match what we have in our PMS?

- How do I calculate ARR and ADR?

-

- Can I edit the figures in the Flash report?

- Different view options in the Flash report

- How am I performing compared to my forecast/budget/last year?

- How can I print the report?

- How can I switch between viewing daily and monthly figures?

- How do I check what segments add to the total daily figure?

- How do I edit my covers?

- Why are my room/guest nights wrong?

- What is the Flash Report

- Why is my revenue wrong?

-

- How do I know if the mapping is correct?

- How do I know where accounts should go in PMI?

- How do I map the categories in Timekeeping (TKS)?

- I cannot see my department in Timekeeping System (TKS) mapping. How do I see it?

- There is a position missing in the Timekeeping system mapping. How can I fix this?

- What are Categories in PMI Timekeeping system?

- What is Departments in Timekeeping system (TKS) mapping?

- What is mapping accounts?

- What is mapping – timekeeping system?

-

d2o team only

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

- Articles coming soon

-

-

KPIs

-

General user knowledge

- Articles coming soon

-

Miscellaneous